Guiding you every step...

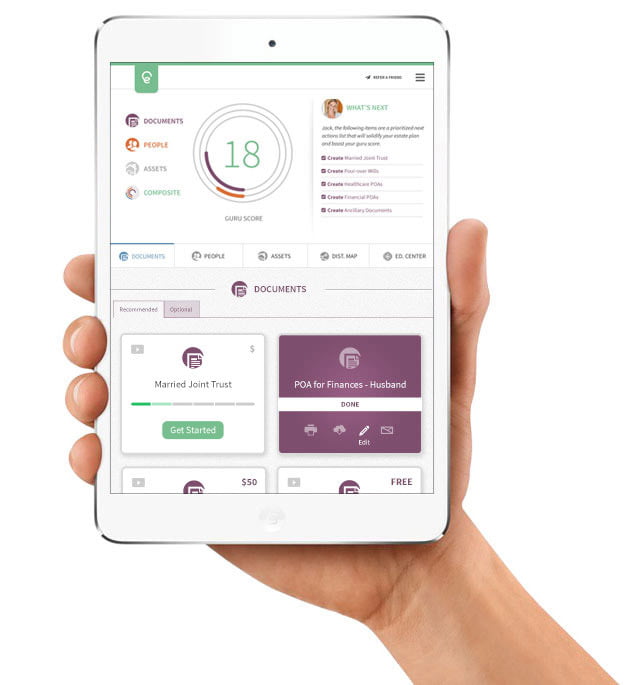

Our Estate Guru app is more than a stack of documents... it's a tool that guides you through every important step of your estate plan.

Create

Create, execute, and fund your estate plan specific to your needs

Create

Create, execute, and fund your estate plan specific to your needs

We Focus On

ESTATE PLANNING / ASSET PROTECTION PLANNING / ADVANCED TAX PLANNING / BUSINESS PLANNING / LEGACY PLANNING

LET US EARN YOUR FAMILY'S TRUST

Our advisors can assist with every planning situation While some advisors cater only to one client demographic, we know that every Family needs a proper plan. That's why we offer planning for every situation and every price range.

Create

Create, execute, and fund your estate plan specific to your needs

Share

Create, execute, and fund your estate plan specific to your needs

Maintain

Helping you know how and when to amend your estate plan as life circumstances change

Settle

Create, execute, and fund your estate plan specific to your needs

Determine Your Estate Planning Needs

We offer personalized solutions to fit your family's needs

Estate Planning Solutions

When most people think of estate planning, they first think of a will. The reality is that most families begin needing a trust plan when they have children and own a home. A comprehensive trust plan can avoid the costs, delay, and publicity of probate, as well as protect property and loved ones during periods of incapacity. Our Attorneys can help you draft and implement the plan your family needs to give them peace of mind when it is needed.

Probate Administration

Handling a loved one’s estate can be difficult especially when they did not leave a comprehensive estate plan. Our Attorneys are experienced in handling probate filings and estate administrations. Even with a will or an improperly funded trust plan, a court process may be necessary. When that happens, our attorneys can help you know what to do and resolve matters quickly and professionally.